Unlikely allies: Iran backs Qatar in oil indexation debate

Iran is to support the linking of gas contracts to oil prices throughout its two-year leadership of the Gas Exporting Countries Forum, it emerged in November. And the move means Qatar has found itself an unlikely ally.

Iranian Oil Minister Bijan Namdar Zanganeh attends the 15th ministerial meeting of Gas Exporting Countries Forum in Tehran, Iran in November with Qatar’s Minister of Industry and Energy HE Saleh Mohammed Al Sada in the background. (Image Corbis)

Iranian Oil Minister Bijan Namdar Zanganeh attends the 15th ministerial meeting of Gas Exporting Countries Forum in Tehran, Iran in November with Qatar’s Minister of Industry and Energy HE Saleh Mohammed Al Sada in the background. (Image Corbis)Iran’s petroleum minister Bijan Zanganeh has come out in favour of linking long-term natural gas supply contracts to movements on oil markets in a move that could have far-reaching ramifications for Qatar’s hydrocarbon export industry. As of this month, Mohammad Adeli, the former governor of Iran’s central bank, begins as the new secretary general of the Gas Exporting Countries Forum (GECF), which counts Qatar as a principal mover among its 13-strong membership.

Adeli will serve a two-year term, during which time he will front Iran’s leadership of the group. This will lend the country, which boasts the world’s second largest proven gas reserves – one place ahead of Qatar in the global rankings – a more influential voice than it would have otherwise possessed over the two-year window.

This will give Iran a platform to shape the debate among gas exporting countries. And one of the most pertinent issues of the day, particularly in relation to large-scale exporters such as Qatar, is that of oil indexation versus gas-hub pricing in long-term deals.

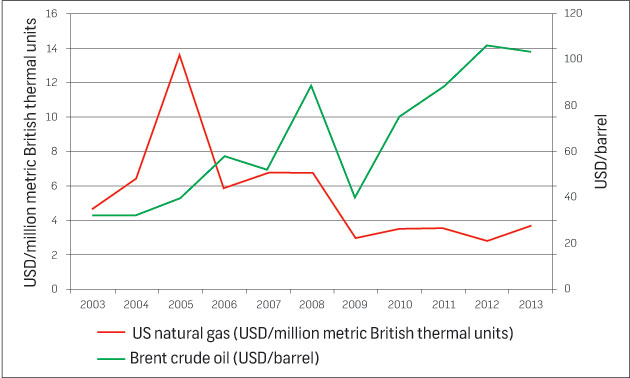

The graph indicates why gas exporters would favour long-term contracts linked to oil prices as opposed to gas hubs, with oil pushing steadily higher (EIA/index mundi)

“Long-term contracts drawn up with formulas based on an oil and gas price connection will continue,” Minister Zanganeh said after a meeting, which marked Adeli’s appointment, to the GECF in the Iranian capital Tehran in November.

The statement was subsequently published by Iran’s Pars Oil and Gas Company, which was set up to develop the giant gas field that the nation shares alongside Qatar.

Point counterpoint

Zanganeh’s statement highlighted the deep fissures between gas exporters and importers that have seen the oil indexation debate run on. “The importers are interested in the issue of independence and the separation of gas prices from oil, [because] they seek stability, but this issue is not backed by the majority of gas producers and exporters,” Zanganeh said.

Of all gas exporting nations, Qatar, alongside Russia, has most to gain – or lose – as a result of the oil indexation debate. Those who argue in favour of oil indexation claim that the long-term demand drivers affecting the underlying commodity of crude oil, such as economic growth, population growth and industrialisation, inherently apply to gas demand as well.

But the counter argument, most forcefully adopted by European nations, is that linking instead to shorter-term gas trading hubs offers a more accurate reflection of the supply and demand fundamentals of the gas market. In effect, the underlying commodity of gas becomes gas itself.

The issue is most relevant to the European market because it is a vast net importer, with indigenous reserves in the north of the continent unable to satiate growing demand. As a result, countries across the continent have slowly broken down the traditional oil-linked model.

A number of court rulings have deemed the oil price link to be flawed, resulting in consuming nations being fundamentally overcharged by exporting countries. Last year, Italy-based energy utility Edison won a QAR2.2 billion discount from Qatar’s RasGas after an arbitration court ruled that the oil-indexation model was economically unsustainable for the purchaser.

With the ever-unpredictable Iran now at the helm of the GECF, however, its Gulf neighbour Qatar could find itself with an unexpected ally – and one that is not afraid to challenge Western countries – as the oil indexation debate continues.

Like this story? Share it.