A resurgence in the GCC construction industry?

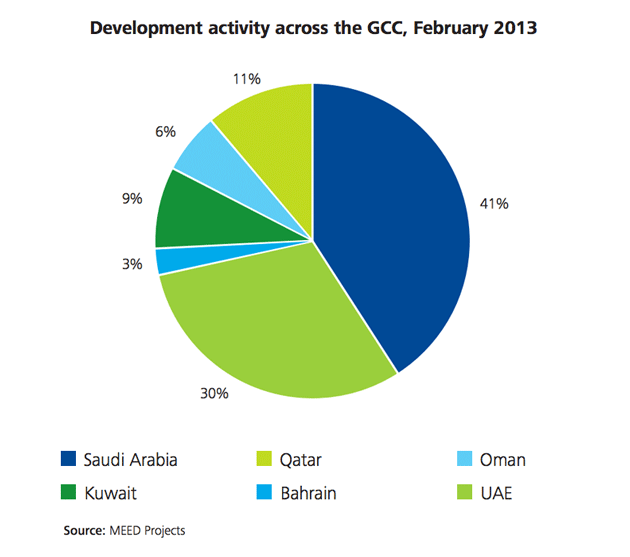

Over the last year the optimism within the GCC construction market has risen considerably as USD70 billion (QAR254.8 billion) worth of construction projects were completed in 2013, with this number predicted to rise in 2014. Residential developments accounted for just over 43 percent of total completed projects, which is expected due to the region’s rapid population growth and thus the governments’ increased social infrastructure spends. The UAE and Saudi Arabia ranked in the top two positions for all sectors apart from education and healthcare where Qatar held the top spot in both.

According to Deloitte Middle East’s newly released annual report on the sector, GCC Powers of Construction 2014, looking forward from 2013 and further ahead it seems like government-led initiatives will continue to drive growth in the GCC construction sector as regional governments continue to focus on social infrastructure projects. The rail industry alone in the GCC could create 50,000 jobs with most nations creating or upgrading their rail networks. These consist of the multi-nation interconnected railway network along with metro and tram projects of which there are many, including Qatar Rail, the Riyadh Metro project, Etihad Rail and the upgrades to the Dubai metro.

“With all this extra infrastructure spend, jobs will be generated with some estimates claiming 30 percent of the potential 300,000 jobs created by Expo 2020 in the UAE alone is expected to be in the construction sector by itself. The Dubai government has also announced that all new and existing construction projects are going to be fast-tracked to be ready for 2020,” said Cynthia Corby, audit partner and leader of the Construction industry for the Middle East. “The demand for skills and resources will of course increase and we would hope that a well-planned and phased development strategy will prevent the price for these resources and for talent from becoming disproportionately expensive,” she added.

The Qatari government is preparing to spend in excess of USD70 billion (QAR254.8 billion) states the report, mainly on infrastructure and transport but also on hotels and stadia, in anticipation of the 2022 World Cup and as part of the Qatar Vision 2030. The Minister of Finance allocated USD24 billion (QAR87 billion) to key projects, an increase of 16 percent from 2013 to 2014, this is also the biggest infrastructure budget in the country’s history. The main focus of investment will however continue to be on improving its social infrastructure. Funds have also been set aside for completing the Hamad International Airport, the New Doha Port Project, the rail and metro projects, and the roads program. A major part of the spending will be on the Qatar Rail project, which is expected to cost around USD45 billion (QAR164 billion) to build.

A major cause for concern are the rising costs within the industry, which the government is trying to keep down through regulating commodities “by creating a single buying source to import into the country run by a government subsidiary which will then sell on to the contractors. Meanwhile, the government has attempted to increase the supply of certain commodities by raising production levels within the country again by creating government subsidiaries which own these commodities and can stockpile them before prices escalate,” states the report.

Rest of the GCC

The UAE market is on track to reach the levels of investment last seen before the recession, and USD12 billion (QAR43.7 billion) of previously stalled projects within the country have now resumed construction. A large proportion of the high-value construction contracts awarded in Saudi Arabia in the last three years have been in the transport sector, particularly aviation and rail. These include the King Abdulaziz International Airport in Jeddah and the Riyadh Metro Project. The Kingdom is also set to award further substantial contracts in the transport sector over the next five years.

Work is picking up in Kuwait and Bahrain but it is Oman that is the one to watch outside UAE, Saudi Arabia and Qatar looking forward. Oman has budgeted for continued strong spending on its infrastructure and tourism sectors. The country announced USD15.5 billion (QAR56 billion) of spending on rail at the end of 2013 as well as the construction of a new town in Duqm.

Among the pan-GCC projects, the GCC rail network is by far the largest project with a combined value close to USD200 billion (QAR728 billion). Construction of the network is scheduled to be completed by 2018. Meanwhile, the contract for a new causeway linking Saudi Arabia and Bahrain is scheduled to be completed in 2014. When completed, these should assist in regional and international trade, with the use of a world-class logistics network connecting all GCC nations.

You can read the full report here.

Like this story? Share it.